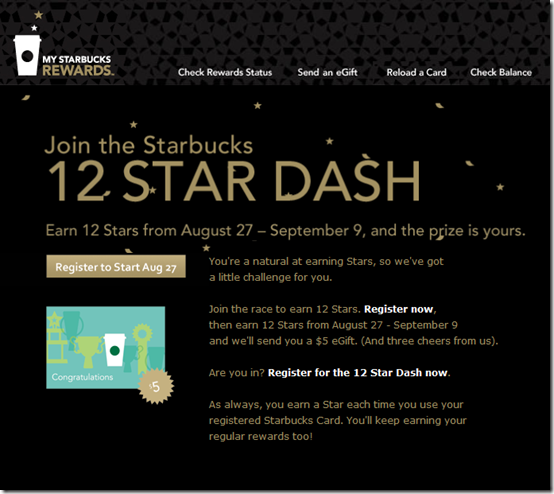

I saw this in the email today:

If Starbucks is a smaller firm, I would view this as a sign of possible cash flow shortage. I.e., the firm needs cash in a hurry, and by giving a discount, it is able to elevated consumer spending in the period of time it needs cash.

However, the size of Starbucks and thus its ability to borrow makes this situation less likely. Looking at its cash flow statement (from Yahoo here), it does have changes in liabilities in March 2012 that reduced cash flow from operations; capital expenditure and investments are elevated in the June 2012 quarter.