In the past 3 days, the 10-year constant maturity yield has fallen 27 basis points (i.e., 0.27%).

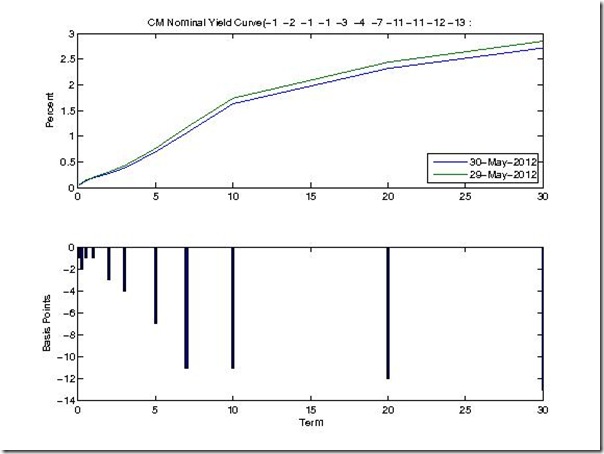

Given that the most recently auctioned 10-year security was issued on May 15, 2012, I would think most of the yield movements are due to demand – and particular flight to safety. The big news today is the bad employment numbers from the non-farm payroll release. The big news yesterday was Europe related (related post here). To sum it up, it is likely that the fall in yield reflect concerns about the global economy. Below are the daily yield change graphs for the past 3 days.