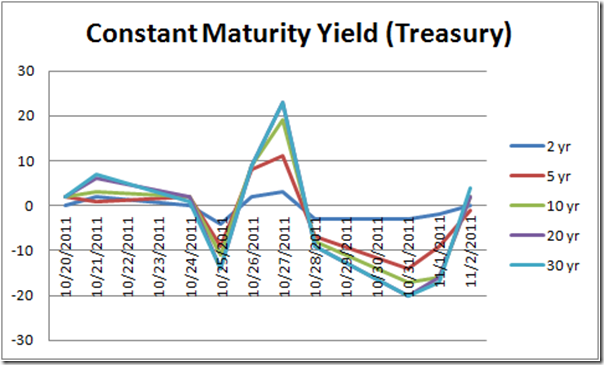

The graph below plots daily change in constant maturity yield (for five maturities from the 2-year yield to the 30-year yield) from October 20 to November 2. Given all the events in Europe these past weeks, the change swings from very negative to very positive to very negative again.

Now, if I were to study the actions of the European Government on US Treasury yields using an event study scheme, how would I analyze the events of the past month? Where would the events be, and how many days should my event windows covers?

These are important considerations when conducting an event study analysis, and underline the method’s potential issues. Outcome can be sensitive to event window size and event selection. Yet, this is a popular scheme in measuring monetary policy effects – from quantitative easing to FOMC announcement effects.

I am starting to think about a paper that I have been putting aside, tentatively titled “Policy Duration Effects under the Zero Interest Rate Environment.” The current version uses the standard event study scheme, and I find myself facing the issues I have described above. I think I have come up with a new way to analyze the data differently, and hope to have a new version of the paper soon.

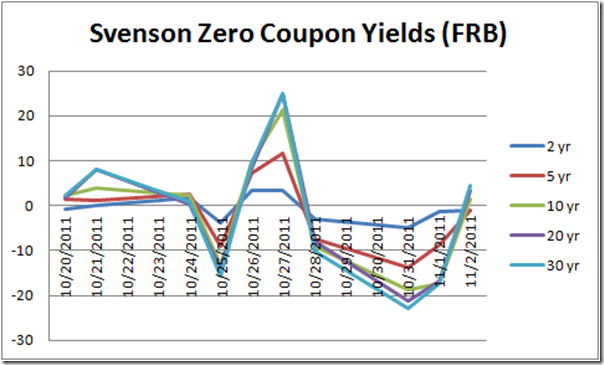

As a side note, I also looked at the Federal Reserve’s Svensson Zero coupon yield (graph below). The Svensson yields are constructed using a different smoothing method than the constant maturity yields from the Treasury Department. The Svensson yields more importantly omit the on-the-run Treasury securities in its estimation, whereas the constant maturity yields use only the on-the-run securities. However, in the past month, the fluctuations between the two sets of yields are similar.

Reference: Daily Treasury Yield Curve Rates [US Department of the Treasury],

FRB: Research Data [Board of Governors of the Federal Reserve System]