On 1/4/2000, the Japanese 10yr yield is 1.743%. The 20yr yield is 2.164%. Approximately 10 years later – on 1/4/2010, the 10yr year for Japan is 1.322%. From the reference here, I think these are constant maturity yield estimated using a fitted curve on semiannual compound interest rate. So, the annualized continuous compound rates are:

10yr, 2000: 1.735449 = 2*ln((1.743/2)+1)Using the standard forward rate formula to calculate the 10yr rate 10 years ahead:

20yr, 2000: 2.385714 = 2*ln((2.4/2)+1)

10yr, 2010: 1.31765 = 2*ln((1.322/2)+1)

3.0359797 = (20*2.385714 – 10*1.735449) / (20 – 10)In other words, in 2000, the prices from the Japanese Government Bonds suggest that the expected 10yr rate in 2010 would be 3.04%. And if in 2000 someone in Japan asks the future me (who has perfect foresight) if I think the long interest rates are too low, I would say no.

Point being – that long rates can stay low for a long time. If the future in the US is anything like that of Japan, rate might not be low at all. Note also that the 10yr rate in Japan in 2000 is *higher* than the 10yr rate in Japan in 2010.

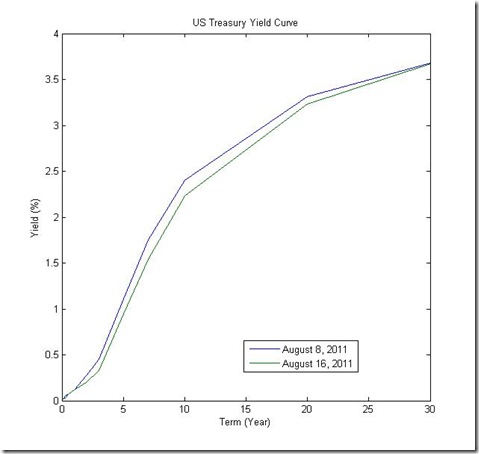

On 8/16/2011, the 10yr US interest rate is 2.23%, and 20yr rate is 3.23%.

Reference: Interest Rate (Q&A), Interest Rate [Ministry of Finance],

Daily Treasury Yield Curve Rates [US Department of the Treasury]