The latest FOMC statement on August 9 announced the following:

The Committee currently anticipates that economic conditions--including low rates of resource utilization and a subdued outlook for inflation over the medium run--are likely to warrant exceptionally low levels for the federal funds rate at least through mid-2013.

The statement reduces the chance of an increase in federal funds rate to nearly zero until mid-2013. Note that the statement does not constraint the committee from raising rates should rates of resource utilization increase or outlook for inflation becomes increasingly likely. However, barring any significant changes, it does eliminate talks of inflation in the current environment by some in the committee.

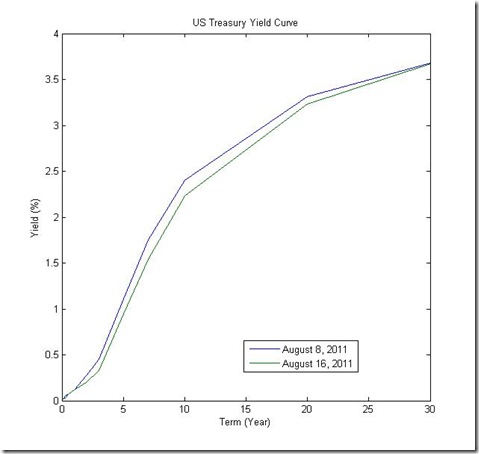

The figure below shows the yield curve from the US Treasury Department shows the yield curve between the day before the FOMC announcement and August 16. The 30yr yield has recovered from the drop last week. However, much of the yield curve is still depressed from last week, and I would expect the short end (correspond to until mid-2013 or a little less than 2 years as of now) to stay depress for some time.

The quick recovery of the 30yr yield also highlights the difficulty in interpreting effects of policy on long Treasury yields. Was the drop last week an overreaction? Were there events from last week to this week that lead to the increase in yield, independent of the effect on yields from the FOMC statement last week? Depending on one or the other, the FOMC action can be interpreted either as having no persistent effects on the long rate or as having persistent effects. The longer the maturity, the more things can influence its movements.

Reference: Daily Treasury Yield Curve Rates [US Department of the Treasury]