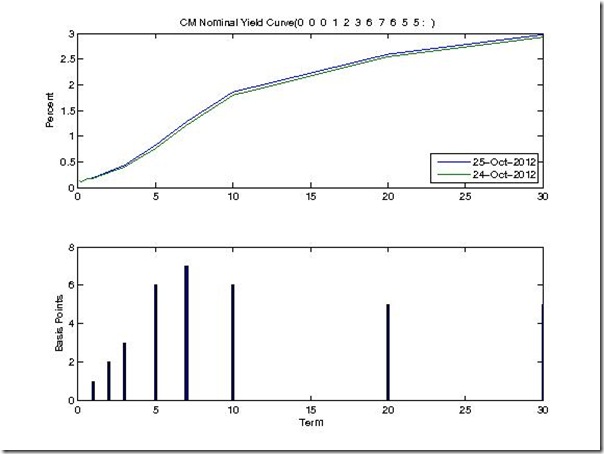

Yields (constant maturity estimated by the Treasury Department) went up yesterday…

… and it went down today.

Presumably, the increase yesterday has to do with supply issues, i.e.:

“Treasuries declined after the U.S. sale of $29 billion in seven-year notes drew of the least demand since May 2009.”

As for the fall today, a plausible explanation:

“Treasuries rose, pushing 10-year yields down from almost the highest in five weeks, as a report showing Spain’s unemployment rate at a record high raised concern the region’s debt crisis may worsen.” “There’s still a flight-to-quality bid being generated by concern for Europe,” said David Coard, head of fixed-income trading in New York at Williams Capital Group, a brokerage for institutional investors. “It’s a roller-coaster ride.”

These types of seesaw actions make event study hard. The problem can be alleviated by using intraday yield data, but that data is costly and you are still trading off measuring the effect of a particular news item versus trusting the market participant’s ability to evaluating the news and trade on it. For example, if you use a 5-minute event window to study the effect of the FOMC statement release – you hope the only relevant news within those 5 minutes is the FOMC release. That is likely. However, you are also trusting that the Treasury price will be able to reflect that news within the 5-minute window also. In some cases, the proper trade off isn’t clear.

Reference: Treasuries Fall as Seven-Year Note Demand Is Least Since 2009 [Bloomberg],

Treasuries Advance on Spain’s Jobless Rise After GDP [Bloomberg Businessweek].