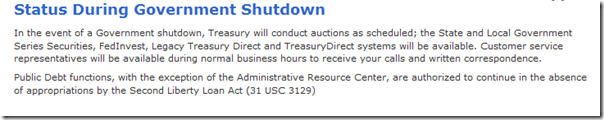

While Congress managed to avert a government shutdown (for now), I was curious whether it would have any impacts on Treasury auctions. The answer appears to be no. From the Treasury Department website:

I looked at Treasury issuance over time, and do not see any noticeable patterns. The one thing I do notice is there appears to be a break over 1997 – when the Treasury Department completely transition from discriminatory auctions with uniform pricing auctions.

Here is the Treasury issuance over time for Treasury Notes/Bonds. The colors represent different maturities. (The blue is the 2-yr securities, the red is the 5-yr, and the green is the 10-yr.)

Here is the graph for Treasury Bills (including cash management bills). The blue are cash management bills, which tend to be issued when there are unanticipated shortfalls. I also see in this figure what appears to be a structural break in the pattern of issuance in the late 1990s. The rather high values of CMBs suggest that there are unanticipated shortfalls over that period, perhaps due to the change in the auction method.

Data source: Historical Auction Query [TreasuryDirect]