Felix Salmon commented that the short end of the yield curve has risen quite a bit on Friday, as the debt ceiling issue looks less likely to be resolved by August 2. My research involves financial markets in general and Treasury market in particular, usually with relevancy to monetary policy. I have been working on information implied by Treasury auctions lately; from auction data, it seems primary dealers and direct bidders are shying away from the short Treasuries Bills, but there are still indirect bidders willing to support the market for a higher yield. The rest of the entry talks about how I arrive at this conclusion.

Here I look specifically at 4-week bills auctioned since June, with maturity dates surrounding the August 2 deadline. There are nine observations total, with the last one on July 26 (Tuesday). While auctions reflect the interactions of market participants in the primary market of the Treasury, they are informative since these same participants also interact in the secondary market. Furthermore, the auction market supply us with additional information that equilibrium points in the secondary market that makes up the yield curve might not. The main drawback of using auction data is that the number of observations is weekly at best. Also, the composition of auction participants is different from those in the secondary market. For the sample here, the primary dealer bids makes up 80% of the total bids. (11.8% for direct bidders and 7.9% for indirect bidders)

The following figure plots the high discount rate (the rate of the 4-week bill determined by the auction). The X-axis plots the maturity date and the Y-axis plots the high discount rate. For the last auction on July 26 (and matures August 25), the high discount rate is relatively higher than the others.

Like Salmon’s commentary, it appears that concerns about the debt ceiling have started to affect the auction market – even for an auction that was auctioned Tuesday. The auction data allows us to dig in a little deeper about the compositions of the bidders.

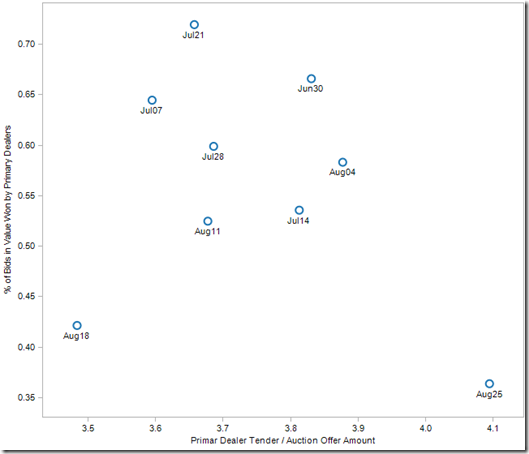

In a Treasury auction, any bidder can submit multiple bids of varying amounts for difference prices. Until the recent auction, primary dealers as a group has won anywhere from 40 to 70% of the amounts they bid (Y-axis), and the amount of bids are usually 3.5 to 3.9 times the amounts offered in an auction (X-axis). The figure below shows that the primary dealers has been winning less securities than average (Y-axis), even though the normalized amount of competitive tender (X-axis) they submit for the auction has been increasing. Furthermore, for the most recent auction, they win a very low percent of the auction.

So what was the outcome of the most recent auction for the other two groups of bidder? The figure below is for direct bidders. The amount of bids are lower than average, but surprisingly, like the primary dealers, the direct bidders too are winning a relatively lower amount of bids.

Finally, for the indirect bidders, the figure below shows that they too are offering a higher amount of bids, as indicated by the relatively higher points for bills with August maturity dates. In fact, it seems they win a relative larger portion of the auctions that the primary dealers and direct bidders forgo. It also seem strange to me that the indirect bidders bid aggressively – that three of the 4 auctions for 4-week Bills maturing in August have a relatively high bid-cover ratio for the group.